Finance is the life blood of business. It flows in mostly from scale of goods and services. It flows out for meeting various types of expenditure. The activating element in any business which may be on industrial or commercial undertaking is the finance.Business finance has been defined as those activities which have to do with the provision and management of funds for the satisfactory conduct of a business. Business finance is defined as that business activity which is concerned with the acquisition and conservation of capital funds in meeting the financial needs and overall objectives of business enterprise.So we can say business finance is mainly developed around three major objectives. Firstly, to obtain an adequate supply of capital for the needs of the business, Secondly, to conserve and increase the capital through better management, Thirdly, to make profit from the use of funds which is an overall objectives of a business enterprise.Before industrial revolution, finance was not of much importance. The methods of production were simple. For example, the artisan used to work in open small hut. He had simple tools mostly made by himself. Labour at that time was more important than capital and finance did not pose any problem. Production in those days was, therefore labour intensive.

Finance is the life blood of business. It flows in mostly from scale of goods and services. It flows out for meeting various types of expenditure. The activating element in any business which may be on industrial or commercial undertaking is the finance.Business finance has been defined as those activities which have to do with the provision and management of funds for the satisfactory conduct of a business. Business finance is defined as that business activity which is concerned with the acquisition and conservation of capital funds in meeting the financial needs and overall objectives of business enterprise.So we can say business finance is mainly developed around three major objectives. Firstly, to obtain an adequate supply of capital for the needs of the business, Secondly, to conserve and increase the capital through better management, Thirdly, to make profit from the use of funds which is an overall objectives of a business enterprise.Before industrial revolution, finance was not of much importance. The methods of production were simple. For example, the artisan used to work in open small hut. He had simple tools mostly made by himself. Labour at that time was more important than capital and finance did not pose any problem. Production in those days was, therefore labour intensive.Friday, December 25, 2009

Finance and its importance

Finance is the life blood of business. It flows in mostly from scale of goods and services. It flows out for meeting various types of expenditure. The activating element in any business which may be on industrial or commercial undertaking is the finance.Business finance has been defined as those activities which have to do with the provision and management of funds for the satisfactory conduct of a business. Business finance is defined as that business activity which is concerned with the acquisition and conservation of capital funds in meeting the financial needs and overall objectives of business enterprise.So we can say business finance is mainly developed around three major objectives. Firstly, to obtain an adequate supply of capital for the needs of the business, Secondly, to conserve and increase the capital through better management, Thirdly, to make profit from the use of funds which is an overall objectives of a business enterprise.Before industrial revolution, finance was not of much importance. The methods of production were simple. For example, the artisan used to work in open small hut. He had simple tools mostly made by himself. Labour at that time was more important than capital and finance did not pose any problem. Production in those days was, therefore labour intensive.

Finance is the life blood of business. It flows in mostly from scale of goods and services. It flows out for meeting various types of expenditure. The activating element in any business which may be on industrial or commercial undertaking is the finance.Business finance has been defined as those activities which have to do with the provision and management of funds for the satisfactory conduct of a business. Business finance is defined as that business activity which is concerned with the acquisition and conservation of capital funds in meeting the financial needs and overall objectives of business enterprise.So we can say business finance is mainly developed around three major objectives. Firstly, to obtain an adequate supply of capital for the needs of the business, Secondly, to conserve and increase the capital through better management, Thirdly, to make profit from the use of funds which is an overall objectives of a business enterprise.Before industrial revolution, finance was not of much importance. The methods of production were simple. For example, the artisan used to work in open small hut. He had simple tools mostly made by himself. Labour at that time was more important than capital and finance did not pose any problem. Production in those days was, therefore labour intensive.World Financial Crisis Not Over

According to Nouriel Roubini: "The real economy still looks very weak.The US economist widely credited with having predicted the financial crisis has warned we are already "planting the seeds of the next crisis". Nouriel Roubini told the BBC that he is concerned about the growing gap between the "bubbly and frothy" stock markets and the real economy. Over the last six months, the Dow Jones Industrial Average has risen about 45%. But Mr Roubini says he sees an economy where consumers are "shopped out" and "debt burdened".Based on the run up in share prices in recent months, investors appear to be betting that good times are around the corner. A view not shared by Mr Roubini. The crisis is not yet over," the New York University professor said.

According to Nouriel Roubini: "The real economy still looks very weak.The US economist widely credited with having predicted the financial crisis has warned we are already "planting the seeds of the next crisis". Nouriel Roubini told the BBC that he is concerned about the growing gap between the "bubbly and frothy" stock markets and the real economy. Over the last six months, the Dow Jones Industrial Average has risen about 45%. But Mr Roubini says he sees an economy where consumers are "shopped out" and "debt burdened".Based on the run up in share prices in recent months, investors appear to be betting that good times are around the corner. A view not shared by Mr Roubini. The crisis is not yet over," the New York University professor said.I think that there is a growing gap between what is the asset prices and the real economy

"I see an economy where the consumers are shopped out, debt burdened, they have to cut back consumption and save more."The financial system is damaged... and for the corporate sector I don't see a lot of capital spending because there is a glut of capacity."Mr Roubini believes US house prices have further to fall, straining America's fragile recovery.Property prices have already declined sharply. According to the National Association of Realtors, the national median has dropped almost 13% from a year ago to $177,700 (£110,100). Many believe the crises in the residential market could spread to the commercial real estate market causing more headaches for the banks. So where does the "froth" in the markets come from?Mr Roubini - like many other economists - believes it is engineered by the Federal Reserve and the government which has been pumping cash into the economy to dampen the pain of the recession"There is a wall of liquidity chasing assets," he said. "But I think that there is a growing gap between what is the asset prices and the real economy."Although he thinks there will be a correction, he believes some of the mistakes of the past can be avoided if reforms are implemented .

Thursday, December 3, 2009

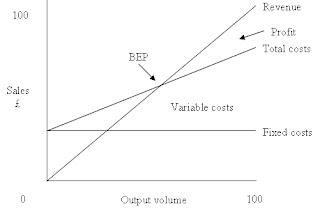

Breakeven analysis

The break-even point for a product is the point where total revenue received equals the total costs associated with the sale of the product (TR=TC).A break-even point is typically calculated in order for businesses to determine if it would be profitable to sell a proposed product, as opposed to attempting to modify an existing product instead so it can be made lucrative. Break even analysis can also be used to analyse the potential profitability of an expenditure in a sales-based business. break even point (for output) = fixed cost / contribution per unit

The break-even point for a product is the point where total revenue received equals the total costs associated with the sale of the product (TR=TC).A break-even point is typically calculated in order for businesses to determine if it would be profitable to sell a proposed product, as opposed to attempting to modify an existing product instead so it can be made lucrative. Break even analysis can also be used to analyse the potential profitability of an expenditure in a sales-based business. break even point (for output) = fixed cost / contribution per unitcontribution (p.u) = selling price (p.u) - variable cost (p.u)

break even point (for sales) = fixed cost / contribution (pu) * sp (pu)

Wednesday, December 2, 2009

Cash flow statement

In financial accounting, a cash flow statement, also known as statement of cash flows or funds flow statement, is a financial statement that shows how changes in balance sheet and income accounts affect cash and cash equivalents, and breaks the analysis down to operating, investing, and financing activities. The statement captures both the current operating results and the accompanying changes in the balance sheet. As an analytical tool, the statement of cash flows is useful in determining the short-term viability of a company, particularly its ability to pay bills. International Accounting Standard 7 (IAS 7), is the International Accounting Standard that deals with cash flow statements.

In financial accounting, a cash flow statement, also known as statement of cash flows or funds flow statement, is a financial statement that shows how changes in balance sheet and income accounts affect cash and cash equivalents, and breaks the analysis down to operating, investing, and financing activities. The statement captures both the current operating results and the accompanying changes in the balance sheet. As an analytical tool, the statement of cash flows is useful in determining the short-term viability of a company, particularly its ability to pay bills. International Accounting Standard 7 (IAS 7), is the International Accounting Standard that deals with cash flow statements.Investment

Investment is the active redirection of resources/assets to creating benefits in the future; the use of resources/assets to earn income or profit in the future. It is related to saving or deferring consumption.Investment is involved in many areas of the economy, such as business management and finance no matter for households, firms, or governments. An investment involves the choice by an individual or an organization such as a pension fund, after some analysis or thought, to place or lend money in a vehicle, instrument or asset, such as property, commodity, stock, bond, financial derivatives (e.g. futures or options), or the foreign asset denominated in foreign currency, that has certain level of risk and provides the possibility of generating returns over a period of time.

Investment is the active redirection of resources/assets to creating benefits in the future; the use of resources/assets to earn income or profit in the future. It is related to saving or deferring consumption.Investment is involved in many areas of the economy, such as business management and finance no matter for households, firms, or governments. An investment involves the choice by an individual or an organization such as a pension fund, after some analysis or thought, to place or lend money in a vehicle, instrument or asset, such as property, commodity, stock, bond, financial derivatives (e.g. futures or options), or the foreign asset denominated in foreign currency, that has certain level of risk and provides the possibility of generating returns over a period of time.Investment comes with the risk of the loss of the principal sum. The investment that has not been thoroughly analyzed can be highly risky with respect to the investment owner because the possibility of losing money is not within the owner's control. The difference between speculation and investment can be subtle. It depends on the investment owner's mind whether the purpose is for lending resource to someone else for economic purpose or not.

In the case of investment, rather than store the good produced or its money equivalent, the investor chooses to use that good either to create a durable consumer or producer good, or to lend the original saved good to another in exchange for either interest or a share of the profits. In the first case, the individual creates durable consumer goods, hoping the services from the good will make his life better. In the second, the individual becomes an entrepreneur using the resource to produce goods and services for others in the hope of a profitable sale. The third case describes a lender, and the fourth describes an investor in a share of the business. In each case, the consumer obtains a durable asset or investment, and accounts for that asset by recording an equivalent liability. As time passes, and both prices and interest rates change, the value of the asset and liability also change.

The term "investment" is used differently in economics and in finance. Economists refer to a real investment (such as a machine or a house), while financial economists refer to a financial asset, such as money that is put into a bank or the market, which may then be used to buy a real asset.

Savings Account

Savings accounts are accounts maintained by retail financial institutions that pay interest but can not be used directly as money ( for example, by writing a cheque). These accounts let customers set aside a portion of their liquid assets while earning a monetary return. Savings accounts are offered by commercial banks, savings and loan associations, credit unions, building societies and mutual savings banks. Some savings accounts require funds to be kept on deposit for a minimum length of time, but most permit unlimited access to funds. In the US, Regulation D, limits the withdrawals, payments, and transfers that a savings account may perform. Banks comply with these regulations differently; some will immediately prevent the transfer from happening, while others will allow the transfer to occur but will notify the account holder upon violation of the regulation. True savings accounts do not offer cheque-writing privileges, although many institutions will call their higher-interest demand accounts or money market accounts "savings accounts."

Savings accounts are accounts maintained by retail financial institutions that pay interest but can not be used directly as money ( for example, by writing a cheque). These accounts let customers set aside a portion of their liquid assets while earning a monetary return. Savings accounts are offered by commercial banks, savings and loan associations, credit unions, building societies and mutual savings banks. Some savings accounts require funds to be kept on deposit for a minimum length of time, but most permit unlimited access to funds. In the US, Regulation D, limits the withdrawals, payments, and transfers that a savings account may perform. Banks comply with these regulations differently; some will immediately prevent the transfer from happening, while others will allow the transfer to occur but will notify the account holder upon violation of the regulation. True savings accounts do not offer cheque-writing privileges, although many institutions will call their higher-interest demand accounts or money market accounts "savings accounts."All savings accounts offer itemized lists of all financial transactions, traditionally through a passbook, but also through a bank statement.

Financial ratio

In finance, a financial ratio or accounting ratio is a ratio of two selected numerical values taken from an enterprise's financial statements. There are many standard ratios used to try to evaluate the overall financial condition of a corporation or other organization. Financial ratios may be used by managers within a firm, by current and potential shareholders (owners) of a firm, and by a firm's creditors. Security analysts use financial ratios to compare the strengths and weaknesses in various companies. If shares in a company are traded in a financial market, the market price of the shares is used in certain financial ratios.

In finance, a financial ratio or accounting ratio is a ratio of two selected numerical values taken from an enterprise's financial statements. There are many standard ratios used to try to evaluate the overall financial condition of a corporation or other organization. Financial ratios may be used by managers within a firm, by current and potential shareholders (owners) of a firm, and by a firm's creditors. Security analysts use financial ratios to compare the strengths and weaknesses in various companies. If shares in a company are traded in a financial market, the market price of the shares is used in certain financial ratios.Ratios may be expressed as a decimal value, such as 0.10, or given as an equivalent percent value, such as 10%. Some ratios are usually quoted as percentages, especially ratios that are usually or always less than 1, such as earnings yield, while others are usually quoted as decimal numbers, especially ratios that are usually more than 1, such as P/E ratio; these latter are also called multiples. Given any ratio, one can take its reciprocal; if the ratio was above 1, the reciprocal will be below 1, and conversely. The reciprocal expresses the same information, but may be more understandable: for instance, the earnings yield can be compared with bond yields, while the P/E ratio cannot be: for example, a P/E ratio of 20 corresponds to an earnings yield of 5%.

Financial analysis

Financial analysis refers to an assessment of the viability, stability and profitability of a business, sub-business or project.

Financial analysis refers to an assessment of the viability, stability and profitability of a business, sub-business or project.It is performed by professionals who prepare reports using ratios that make use of information taken from financial statements and other reports. These reports are usually presented to top management as one of their bases in making business decisions. Based on these reports management may:

Continue or discontinue its main operation or part of its business; Make or purchase certain materials in the manufacture of its product;

Acquire or rent/lease certain machineries and equipment in the production of its goods;

Issue stocks or negotiate for a bank loan to increase its working capital;

Make decisions regarding investing or lending capital;

Other decisions that allow management to make an informed selection on various alternatives in the conduct of its business.

Financial analysis often deals with company's profit. It helps to know the financial position of the company with the help of financial statement(income statement and balancesheet).

Tuesday, December 1, 2009

CAPM Model

In finance, the capital asset pricing model (CAPM) is used to determine a theoretically appropriate required rate of return of an asset, if that asset is to be added to an already well-diversified portfolio, given that asset's non-diversifiable risk. The model takes into account the asset's sensitivity to non-diversifiable risk (also known as systematic risk or market risk), often represented by the quantity beta (β) in the financial industry, as well as the expected return of the market and the expected return of a theoretical risk-free asset.

In finance, the capital asset pricing model (CAPM) is used to determine a theoretically appropriate required rate of return of an asset, if that asset is to be added to an already well-diversified portfolio, given that asset's non-diversifiable risk. The model takes into account the asset's sensitivity to non-diversifiable risk (also known as systematic risk or market risk), often represented by the quantity beta (β) in the financial industry, as well as the expected return of the market and the expected return of a theoretical risk-free asset.The model was introduced by Jack Treynor (1961, 1962), William Sharpe (1964), John Lintner (1965a,b) and Jan Mossin (1966) independently, building on the earlier work of Harry Markowitz on diversification and modern portfolio theory. Sharpe, Markowitz and Merton Miller jointly received the Nobel Memorial Prize in Economics for this contribution to the field of financial economics.

Return

In finance, rate of return (ROR), also known as return on investment (ROI), rate of profit or sometimes just return, is the ratio of money gained or lost (whether realized or unrealized) on an investment relative to the amount of money invested. The amount of money gained or lost may be referred to as interest, profit/loss, gain/loss, or net income/loss. The money invested may be referred to as the asset, capital, principal, or the cost basis of the investment. ROI is usually expressed as a percentage rather than a fraction.The annual return on an investment, expressed as a percentage of the total amount invested. also called rate of return.The yield of a fixed income security is also called return. Return is same as tax return. In finance if there is return then there is risk. so, in any business if return is to be gained then they should also bear risk. Higher the return higher the risk. So, risk and return both are the important parts of finance. Both risk and return plays vital role in financing.

Risk

Risk concerns the expected value of one or more results of one or more future events. Technically, the value of those results may be positive or negative. However, general usage tends focus only on potential harm that may arise from a future event, which may accrue either from incurring a cost ("downside risk") or by failing to attain some benefit ("upside risk").

Risk concerns the expected value of one or more results of one or more future events. Technically, the value of those results may be positive or negative. However, general usage tends focus only on potential harm that may arise from a future event, which may accrue either from incurring a cost ("downside risk") or by failing to attain some benefit ("upside risk").The term risk may be traced back to classical Greek rizikon meaning root, later used in Latin for cliff. The term is used in Homer’s Rhapsody M of Odyssey "Sirens, Scylla, Charybdee and the bulls of Helios (Sun)" Odysseus tried to save himself from Charybdee at the cliffs of Scylla, where his ship was destroyed by heavy seas generated by Zeus as a punishment for his crew killing before the bulls of Helios (the god of the sun), by grapping the roots of a wild fig tree.

Capital Structure

In finance, capital structure refers to the way a corporation finances its assets through some combination of equity, debt, or hybrid securities. A firm's capital structure is then the composition or 'structure' of its liabilities. For example, a firm that sells $20 billion in equity and $80 billion in debt is said to be 20% equity-financed and 80% debt-financed. The firm's ratio of debt to total financing, 80% in this example, is referred to as the firm's leverage. In reality, capital structure may be highly complex and include tens of sources. Gearing Ratio is the proportion of the capital employed of the firm which come from outside of the business finance, e.g. by taking a short term loan etc.

In finance, capital structure refers to the way a corporation finances its assets through some combination of equity, debt, or hybrid securities. A firm's capital structure is then the composition or 'structure' of its liabilities. For example, a firm that sells $20 billion in equity and $80 billion in debt is said to be 20% equity-financed and 80% debt-financed. The firm's ratio of debt to total financing, 80% in this example, is referred to as the firm's leverage. In reality, capital structure may be highly complex and include tens of sources. Gearing Ratio is the proportion of the capital employed of the firm which come from outside of the business finance, e.g. by taking a short term loan etc.The Modigliani-Miller theorem, proposed by Franco Modigliani and Merton Miller, forms the basis for modern thinking on capital structure, though it is generally viewed as a purely theoretical result since it assumes away many important factors in the capital structure decision. The theorem states that, in a perfect market, how a firm is financed is irrelevant to its value. This result provides the base with which to examine real world reasons why capital structure is relevant, that is, a company's value is affected by the capital structure it employs. These other reasons include bankruptcy costs, agency costs, taxes, information asymmetry, to name some. This analysis can then be extended to look at whether there is in fact an optimal capital structure: the one which maximizes the value of the firm.

Managerial Finance

Managerial finance is the branch of finance that concerns itself with the managerial significance of finance techniques. It is focused on assessment rather than technique.

Managerial finance is the branch of finance that concerns itself with the managerial significance of finance techniques. It is focused on assessment rather than technique.The difference between a managerial and a technical approach can be seen in the questions one might ask of annual reports. One concerned with technique would be primarily interested in measurement. They would ask: are moneys being assigned to the right categories? Were generally accepted accounting principles GAAP followed?

One concerned with management though would want to know what the figures mean.

They might compare the returns to other businesses in their industry and ask: are we performing better or worse than our peers? If so, what is the source of the problem? Do we have the same profit margins? If not why? Do we have the same expenses? Are we paying more for something than our peers?

They may look at changes in asset balances looking for red flags that indicate problems with bill collection or bad debt.

They will analyze working capital to anticipate future cash flow problems.

Managerial finance is an interdisciplinary approach that borrows from both managerial accounting and corporate finance.

Time value of money

The time value of money is the value of money figuring in a given amount of interest earned over a given amount of time. Time value of money determines the amount of cash flows ie cash inflows and cash outflows during given time period.

The time value of money is the value of money figuring in a given amount of interest earned over a given amount of time. Time value of money determines the amount of cash flows ie cash inflows and cash outflows during given time period.For example, 100 dollars of today's money invested for one year and earning 5 percent interest will be worth 105 dollars after one year. Therefore, 100 dollars paid now or 105 dollars paid exactly one year from now both have the same value to the recipient assuming 5 percent interest; using time value of money terminology, 100 dollars invested for one year at 5 percent interest has a future value of 105 dollars.This notion dates at least to Martín de Azpilcueta (1491-1586) of the School of Salamanca.

The method also allows the valuation of a likely stream of income in the future, in such a way that the annual incomes are discounted and then added together, thus providing a lump-sum "present value" of the entire income stream.

All of the standard calculations for time value of money derive from the most basic algebraic expression for the present value of a future sum, "discounted" to the present by an amount equal to the time value of money. For example, a sum of FV to be received in one year is discounted (at the rate of interest r) to give a sum of PV at present: PV = FV − r·PV = FV/(1+r).

Some standard calculations based on the time value of money are:

Present Value :The current worth of a future sum of money or stream of cash flows given a specified rate of return. Future cash flows are discounted at the discount rate, and the higher the discount rate, the lower the present value of the future cash flows. Determining the appropriate discount rate is the key to properly valuing future cash flows, whether they be earnings or obligations.

Present Value of an Annuity :An annuity is a series of equal payments or receipts that occur at evenly spaced intervals. Leases and rental payments are examples. The payments or receipts occur at the end of each period for an ordinary annuity while they occur at the beginning of each period for an annuity due.

Present Value of a Perpetuity is an infinite and constant stream of identical cash flows.

Future Value is the value of an asset or cash at a specified date in the future that is equivalent in value to a specified sum today.

Future Value of an Annuity (FVA) is the future value of a stream of payments (annuity), assuming the payments are invested at a given rate of interest.

Subscribe to:

Comments (Atom)